Two weeks since Russia began the biggest conflict in Europe since World War II, businesses across the continent are already in varying stages of despair at the consequences on livelihoods from economic sanctions.

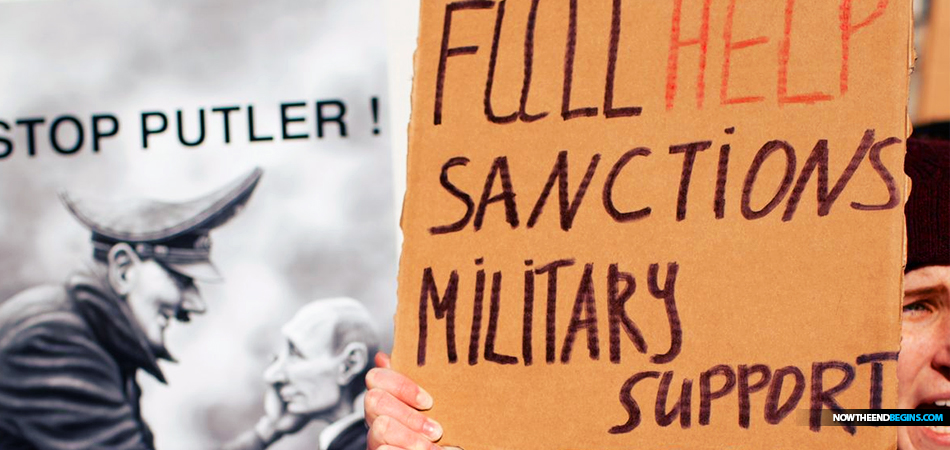

Economic sanctions to bring Putler and Russia to their knees? Don't count on it. In fact, the sanctions placed on Russia over the past 2 weeks is hurting the economies of Europe just as much as it is Russia, and on some levels, even more so. The thing people forget is that Russia is a nation whose people have suffering as their birthright, shutting down McDonald's and Starbucks doesn't do anything. But $20 a gallon petrol for the Europeans will wreck their lives and inflict pain that they will not likely survive.

"And the famine was sore in the land." Genesis 43:1 (KJB)

In many places in the Middle East, flour is already being rationed as Ukraine and Russia account for nearly 30 percent of wheat, 17 percent of corn and over half of sunflower seed oil exports. Critically, Russia is also a major exporter of fertilizer, the price of which has already been soaring. Significant disruptions of Russian exports could see that price jump more — further driving up the cost of food production globally. In the United States soaring gas prices combined with the Biden inflation is already beginning to be felt. But Bidenflation was already in progress before Russia invaded Ukraine.

Thanks To Your Support Of This Ministry, Now The End Begins Launches Whole New Site With Record Number Of King James Bibles Given Out

Thanks To Your Support Of This Ministry, Now The End Begins Launches Whole New Site With Record Number Of King James Bibles Given Out

Shockwaves Spread as Europe’s Economy Reels at Energy Fallout

FROM YAHOO NEWS: A crisis of human suffering in Ukraine, whose wider economic impact prompted European Central Bank officials to quicken their withdrawal from stimulus this week, is affecting prosperity from the farmlands of Spain to the euro zone’s manufacturing core in Germany and France.

Surging energy costs are the central complaint, though disrupted supply chains, sanctions and worries about a looming demand drop are also weighing on enterprises. The abrupt shock of war nearby, combined with broad effects and an uncertain duration, will pile pressure on governments to cushion the blow as well as testing their resolve to confront Russia.

“I don’t know what to do if the war in Ukraine continues for much longer,” Spanish pig farmer Lorenzo Rivera said in an interview this week. “I either have to halt production -- or close business for good.”

Rivera, whose 200 sows outnumber people in Peleas de Arriba, the settlement in northern Spain where he lives, has endured cost increases for a while -- first electricity, then fuel, and then animal feed. It was all manageable until war broke out on the other side of the continent.

The root of the difficulty is the European Union’s reliance on Ukraine for over half its supply of corn, a key source of feed for pigs. With farmers unable to access fields, analysts are slashing outlooks for crops and exports there by as much as a third, sending prices to the highest in about a decade. Other economic disruption is being inflicted by the geography of the crisis. In Germany, the heartland of the euro-zone economy, Porsche AG stopped production of its Taycan electric car in Stuttgart because it lacks cable trees made in Ukraine. Meanwhile its parent, Volkswagen AG, has halted exports to Russia and stopped production at an auto factory in Kaluga outside Moscow.

Most onerous is the energy impact. If current prices persist, the extra cost of importing gas and oil will amount to an income shock of 550 billion euros ($605 billion) or 4.5% of annual gross domestic product, according to JPMorgan economist Greg Fuzesi. Goldman Sachs now reckons inflation will reach toward 8% and the euro zone will suffer a contraction in the second quarter. To many euro-zone businesses, that pinch has been immediately crippling. Just in December, Manuel Rodriguez’s Groupe Kramer took over a century-old porcelain factory in eastern France called Jurassienne de Ceramique Francaise. He has now taken the painful decision to put it in hibernation.

“If we were to pay a gas bill that’s increased 10-fold, we’d hit the wall,” he said. “We would have no other choice but to file for bankruptcy and close down the factory.”

Heading south, along Italy’s coastline, the spiraling cost of fuel has also left many trawlers unable to go to sea and sparked a week-long strike of fishing boats. Carlo Lista, who owns a fishmonger business in Rome’s Monteverde district, says the effect has been dramatic.

“About 80% of fishing boats have stopped due to the surge in fuel prices,” he said. “You go there, and it’s maybe one boat, and one guy bids and then another, and the price just goes up -- whoever bids more gets the fish. Prices are just soaring and soaring.”

Grumpy fishermen are calling on Italy’s government to do something about their predicament beyond the 16 billion euros already spent to protect consumers and companies from rising energy costs. That’s a plea being echoed around the continent. In Spain, Prime Minister Pedro Sanchez has already extended a series of energy tax breaks to the end of June. Portugal will cut fuel levies starting on Friday, and other counterparts are likely to take similar action.

With the EU also under pressure to act, leaders are discussing the crisis in Versailles on Friday. One measure the bloc could consider would be to temporarily lift a ban on imports of genetically modified grains from the U.S. and South America to help farmers struggling with supply disruptions, according to Spain’s Agriculture Minister Luis Planas.

What Bloomberg Economics Says...

“If the gas supply is turned off, Germany and Eastern Europe almost certainly face a crunching blow to output, pushing the euro area into recession.”

The political impact of the cost-of-living squeeze is ultimately likely to test the continent’s resolve to keep confronting Russia at a time when its president, Vladimir Putin, is threatening to shut off gas supplies amounting to about a third of EU consumption.

“This is a sword of Damocles,” said Yves Dubief, whose grandfather founded textile weaver Tenthorey, an employer of 50 people in northeastern France that produces 5 million meters of cloth a year. In such circumstances, the business leader says the state would need to revive measures used during Covid to need help with fixed costs and furloughing workers. “If there is an embargo and we have to reduce our production, whatever the price of gas, it will be a question of whether we are compensated by public authorities.”

While such challenges are likely to focus governments in coming weeks, the most immediate task of addressing economic fallout has been left to ECB President Christine Lagarde. Officials accelerated stimulus withdrawal on Thursday as they unveiled forecasts showing inflation averaging 5.1% this year. The war presents a “substantial upside risk” to prices, she said.

Rodriguez, the French ceramics entrepreneur, looks on that threat with dread. He warns that the problems he’s seeing are likely to cascade throughout global manufacturing.

“There is a domino effect,” he said. “All big industrial firms on the planet have the same problem. In the more or less long term, we will all be faced with this problem of gas that’s too expensive.” READ MORE

No comments:

Post a Comment